Managing External Shocks in Commodity-Exporting Economies: Insights from Mongolia

Policymakers face substantial challenges in managing capital flows, while at the same time stabilizing economies. With these challenges in mind, the Integrated Policy Framework (IPF) has been developed as a systematic approach to analyzing policy responses combining several tools. However, existing models have not focused on the role of IPF tools in dealing with shocks on global commodity demand and prices, which are crucial for commodity-exporting economies like Mongolia.

In this context, our recent paper (Doojav and Gantumur 2023) develops a model that captures the impact of different policy tools and external shocks on a commodity-exporting economy, and examines the optimal combination of policies in a quantitative framework. By analyzing the transmission mechanisms and optimal policy conduct, we provide insights into the importance of policy cooperation and the joint use of various policies in response to shocks. Our analysis focuses on Mongolia, a developing economy heavily dependent on commodity markets.

Our findings show that external shocks, such as commodity demand, commodity price, risk premium, and oil price shocks, significantly impaact the Mongolian economy. They account for a large portion of economic fluctuations and have driven recent business cycles, including the COVID-19 recession. We also find that a mix of policies can help resolve trade-offs. However, a lack of policy cooperation can result in conflicting policies and suboptimal economic stability.

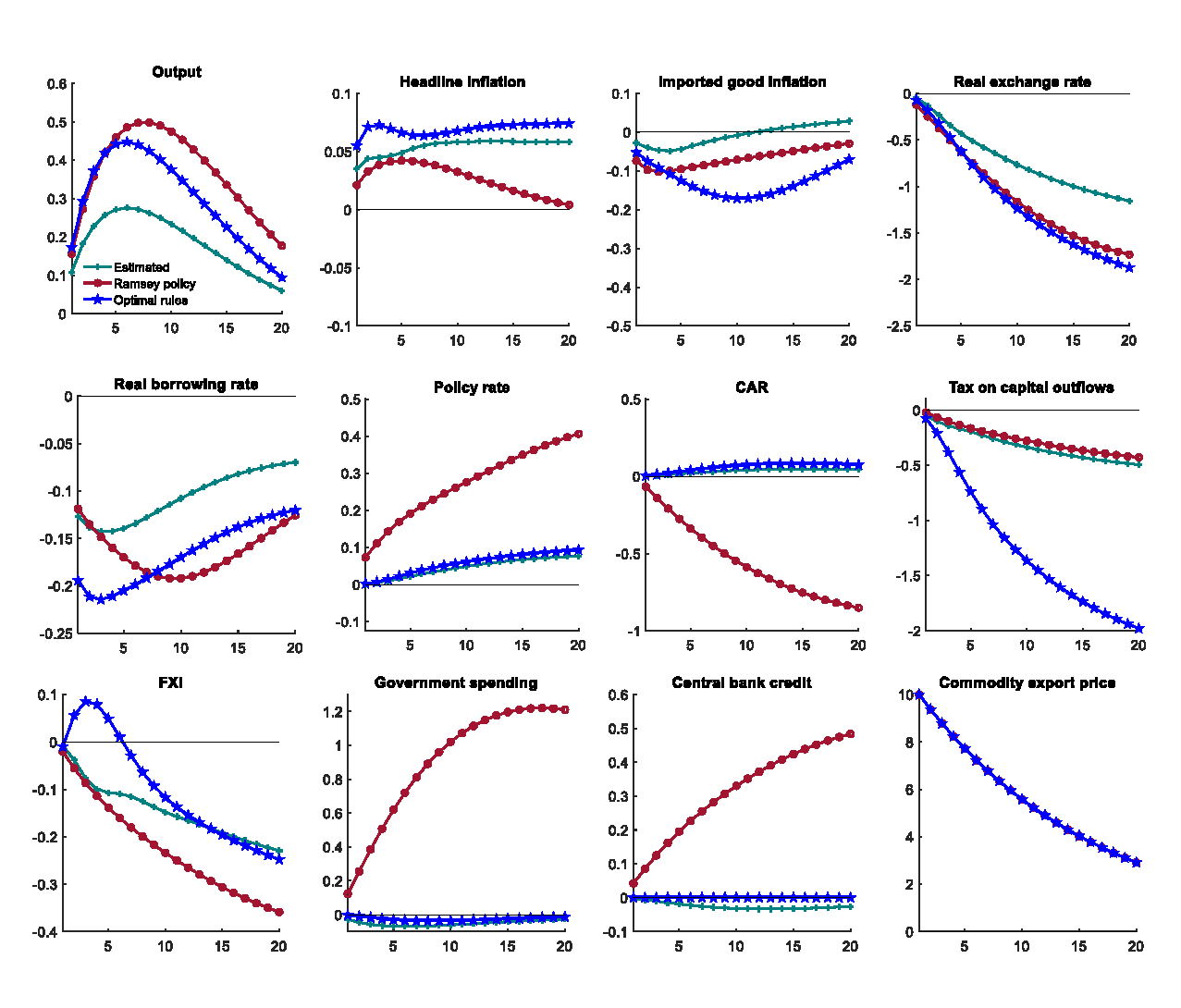

Our analysis points that policymakers should consider an integrated approach and use a combination of policies to address external shocks effectively. Specifically, conventional monetary policy plays a key role in stabilizing inflation and output, while foreign exchange intervention and capital flow management measures can enhance monetary autonomy and stabilize imported inflation. Fiscal and macroprudential policies can help counterbalance the effects of other policy measures on real variables. This broad and coordinated policy approach can help mitigate the negative impacts of shocks and promote stability in key economic indicators. For instance, in response to a positive global commodity price shock, the Ramsey optimal policy suggests a specific set of actions to stabilize the economy. These actions include a gradual but continuous foreign exchange intervention (FXI) to buy foreign currency, capital flows management (CFM) measure, and a tightening of conventional monetary policy to control inflation. However, the impact of these tight policies on output is balanced by gradual fiscal measures, unconventional monetary policies and macroprudential policy actions. While this mix of policies helps to stabilize prices better, it can slightly increase the effects on real aspects of the economy, such as output and employment, in the medium term (Figure 1).

In conclusion, our findings highlight the importance of considering external shocks and adopting an integrated policy approach in commodity-exporting economies. Policymakers should prioritize policy cooperation and coordination to achieve optimal economic outcomes. Further research can explore additional constraints and tools, as well as different economic circumstances, to deepen our understanding of optimal policy mixes.

Gan-Ochir Doojav and Munkhbayar Gantumur (2023), The Bank of Mongolia.

“An Estimated Model of a Commodity-Exporting Economy for the Integrated Policy Framework: Evidence from Mongolia”, IHEID Working Papers 05-2023, Economics Section, The Graduate Institute of International Studies.

https://bccprogramme.org/wp-content/uploads/2023/04/HEIDWP05-2023-2-Gan-Ochir-Munkhbayar.pdf

Figure 1. Impulse response functions to a positive global commodity price shock

Notes: Lines with “+” marker represent impulse responses of the estimated model, lines with “o” marker represent

impulse responses under Ramsey policy, and lines with “⋆” marker are impulses responses under optimal rules.