How effective are foreign exchange interventions under inflation targeting?

Anton Grui, National Bank of Ukraine

Ukraine has been hit by no fewer than three crises in 2014–2015: a macroeconomic crisis driven by the annexation of Crimea and the military conflict in Donbass; an exchange rate crisis as the fixed exchange rate was abandoned in the face of growing current account imbalances and government budget deficits, fueling an inflation outbreak; and a banking crisis as oligarchic banking led to an increase in arrears and panic withdrawals of deposits. All three components intensified each other.

As the saying goes, “one should never let a good crisis go to waste”. After abandoning the fixed exchange rate regime, the National Bank of Ukraine (NBU) was reformed and moved towards inflation targeting (IT) with a floating exchange rate. Yet, many Ukrainians were gravely hit by the devaluation due to a large share of imported goods in a consumer basket and a high credit dollarization. Ever since, it is painfully hard to explain why a fixed exchange rate at 8 Ukrainian hryvnia per US dollar was bad and a floating exchange rate at 24-28 hryvnia per dollar is good.

The NBU thus finds it hard to ignore the exchange rate. Given the high public attention, it uses foreign exchange (FX) interventions as an additional monetary policy instrument with a view to smooth exchange rate volatility and accumulate international reserves. Many emerging market economies pursue IT, while also engaging in various degrees of exchange rate management. While a flexible exchange rate facilitates necessary price adjustments to changed external conditions or domestic fundamentals, erratic shifts in investors’ sentiments may also cause excessive exchange rate fluctuations, which become a source of economic disruptions by their own.

In a recent study (Grui, 2020) I assess the performance of FX interventions under an IT regime in Ukraine using a New Keynesian model with a modified uncovered interest parity (UIP) condition that accounts for the exchange rate management by a central bank. Specifically, I address two policy-relevant issues. First, to what extent is exchange rate management able to support price stability? Second, what is the effect of interventions on the exchange rate?

1.Price stability

FX interventions in 2015–2020:Q1 were aimed at smoothing the exchange rate and, consequently, inflation. The model allows us to simulate the volatilities of the main macroeconomic variables if interventions had been larger, or had not taken place at all. The simulations show that moderately managed floating exchange rate has been on point to stabilize the economy.

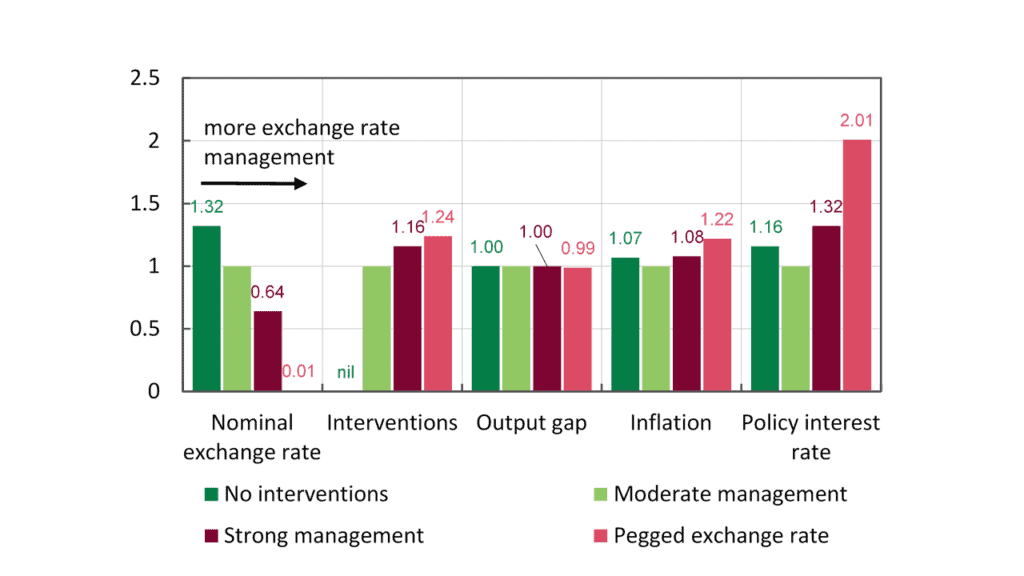

Moderate amounts of FX interventions (as in 2015–2020:Q1) reduced volatility of both nominal exchange rate and inflation. Figure 1 shows the volatility of the exchange rate, interventions, the output gap, inflation and the policy interest rate under four alternative exchange rate policies (no interventions, moderate management, strong management, and a peg). Leaning against excessive exchange rate fluctuations is sensible in an open economy with high pass-through and not well anchored inflation expectations. Nevertheless, the exchange rate must remain floating in order to serve as an important economic stabilization mechanism. Its strong management could have led to more volatile inflation and policy interest rate.

Figure 1. Simulated standard deviations of main macroeconomic variables under various degrees of exchange rate management

The model shows that interventions stabilize the exchange rate, as the FX interventions in 2015–2020:Q1 prevented the exchange rate from being 32% more volatile. Unsurprisingly, the stronger the exchange rate management, the more volatile the interventions are. The impact on inflation is contrasted. FX interventions in 2015–2020:Q1 stabilized inflation, but a more aggressive policy would have worked in the other direction. A similar pattern is observed with interest rate volatility that increases when exchange rate management becomes more active. A further 36% reduction in exchange rate volatility would have been associated with 8% additional inflation volatility and 32% additional policy interest rate volatility.

Output gap volatility demonstrates virtually no response to changes in the exchange rate management. Inelastic output undermines the monetary policy’s ability to influence inflation through aggregate demand. Under such conditions, it is particularly painful to peg exchange rate and strip economy from yet another policy transmission channel.

2.Effect from interventions

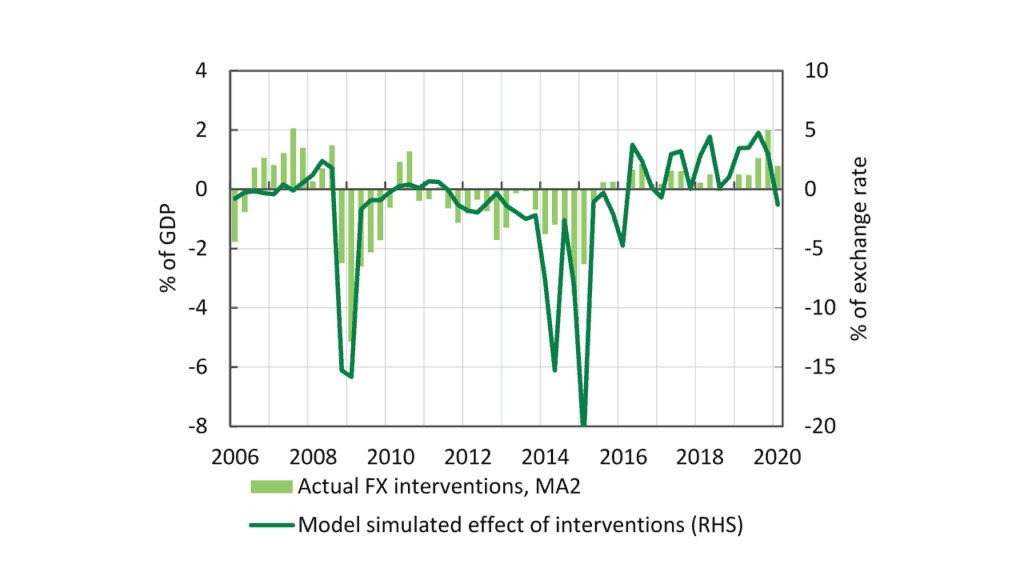

Each additional dollar bought or sold by the NBU on the FX market influences the level of the exchange rate. The model interprets systematic deviations from the UIP as an effect of interventions. Comparing simulated effect of interventions to the actually observed series (and running an OLS) allows estimating the effectiveness of the latter (Figure 2).

Figure 2. Simulated interventions in comparison to actually observed series

Estimates indicate that FX interventions under IT have a strong and lasting effect on the nominal exchange rate in Ukraine. Additional dollar purchases by 1 percent of GDP in 2015–2020:Q1 weaken the exchange rate by 5.8% over the course of two quarters. The effect is assumed to be linear for both sales and purchases. In 2019 terms, USD 273 million are needed to nudge the exchange rate by 1% in a necessary direction.

Sterilized FX interventions under IT are influencing the nominal exchange rate three times more effectively than non-sterilized ones under the fixed exchange rate regime. First, heavy interventions may induce carry trade, which reduces their effectiveness. Second, interventions are not able to defend an exchange rate level forever in case of changed fundamentals. Instead, they should only address temporary shocks. Finally, effectiveness of FX interventions increases with better monetary policy credibility. It turns out that if a central bank does not guarantee any specific level of the exchange rate, it becomes easier to live to the promise.

References

Grui, A. (2020). Uncovered interest parity with foreign exchange interventions under exchange rate peg and inflation targeting: The case of Ukraine (No. 14-2020). Economics Section, The Graduate Institute of International Studies.