How does climate change impact the financial stability policy of the Central Bank of Tunisia?

Nacef ABDENNADHER, Dr & Ramzi SALEM Banque Centrale de Tunisie

Climate change is seen as a major long term shock affecting the world economy. Climate change is a multidimensional threat that affects all the aspects of human life such as food security, migration, physical capital losses and thus, financial stability. The issue is even more challenging for the developing countries.

Many papers have documented the relationship between climate change and economic activity, and we can confidently say that the impact is significantly negative and requires policy action. At the same time, a precise assessment remains difficult because of many complexities and uncertainties, in part because of the long term aspect of the issue. Policies should involve many stakeholders (governments, civil society, firms, Central Bank) and are multidimensional (environmental, fiscal, monetary and macroprudential).

Within the range of policies aimed at dealing with climate change, central banks can be tasked to mitigate the impact on financial stability come from the many constraints driven by environmental change. Specifically, it threatens financial stability via 3 channels: physical risk, transition risk and liability risk. Physical risk reflects the frequency and magnitude of extreme weather events (storms, heavy rain, flooding, drought and associated wildfires, and heat waves) that are increasingly unpredictable. Transition risk is linked to the timing of measures implemented to reduce CO2 emissions, as governments can in some cases introduce very high taxes and customs tariffs on certain industries, equipment or raw materials. Borrowers operating in the sectors most targeted by the new taxes and measures would see the value of their assets decline and may not be able to repay their loans. Liability risk is the possibility that a party can be held responsible for certain types of losses. Many businesses face various types of liability risk, leading to losses which can be quite substantial. Liability coverage is therefore extremely important for these companies. The most exposed agents to climate change financial risk are banks and insurers.

Tunisia is conscious about climate change risks and has integrated environment protection in the 2014 constitution. As a member of the “Paris agreement”, Tunisia submitted his first Nationally Determined Contribution (NDC) in September 2015. In 2020, Tunisian NDC[1] updated, Adoption of the National Strategy of low Carbon.

In parallel, the Tunisian Financial sector has subscribed to the environment protection and in 2019, the Central Bank of Tunisia became member in the Network of Central Banks and Supervisors for the Greening of Financial System (NGFS).

Some Tunisian banks have started to apply rules in line with international practices in terms of green finance. However, the financing of the ambitious objectives for the energy transition, the horizon of which extends to 2030, should require a consolidation of the efforts of financial institutions in terms of financing and support.

The central bank of Tunisia is in the process of establishing a CSR strategy, in which it will certainly put its capacities and skills in order to develop and make available to the banking system financing means and standards which should accelerate the pace of the energy transition.

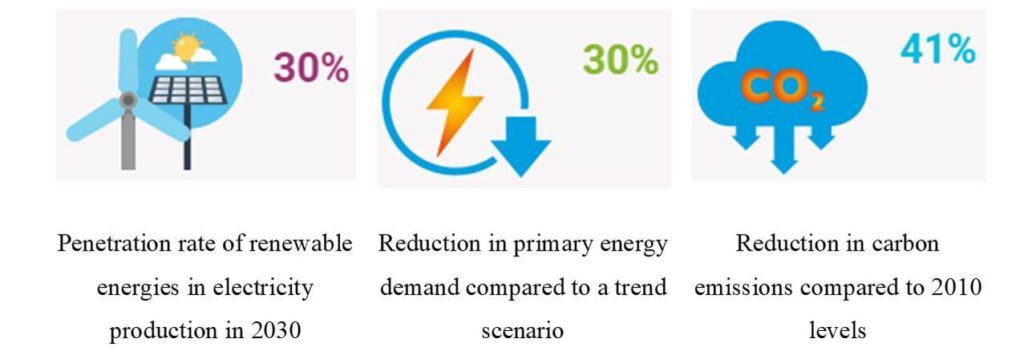

[1] The NDC traces the commitment of a given country to introduce renewable energy in all energy production until a given share is reached, reduce primary energy demand to a target threshold and reduce carbon emissions to a desired level.