How do foreign and local investors in the forward market affect the exchange rate in Colombia?

A recent research paper shows that positions of foreign and local investors in the foreign exchange forward market impact the exchange rate in Colombia at different frequencies.[1] This blog post examines the role of different sectors in the derivatives market, and their potential effect with other fundamentals on the spot exchange rate in Colombia using wavelet analysis.[2]

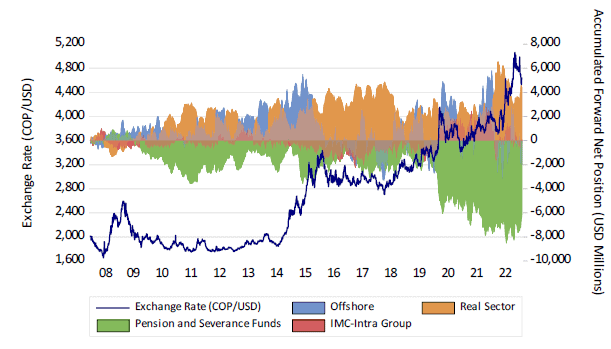

Evolution of non-forward delivery market (NDF) positions by type of investor

Forward net positions allow dollar market participants to protect themselves against the risk of strong currency depreciation. Therefore, whoever has a debt in dollars or must make a payment in dollars will be able to guarantee the price of dollars they require and reduce uncertainty about future dollar payments. The figure below depicts the pattern of the accumulated forward net position of different agents with intermediaries of the foreign exchange market (IMC) in Colombia, from January 2, 2008 to January 31, 2023. While foreign investors (offshore), and the real sector usually take long (NDF) positions to hedge their investments, pension funds and severance funds (PSF) usually take a net selling position to hedge their investments abroad, by selling future USD income. Generally, IMC in Colombia maintain their foreign exchange exposure very close to zero, which implies that their positions in the spot market are offset, as are their positions in the derivatives market. Therefore, through this channel they can influence the pattern of the spot exchange rate.

The Spot Exchange Rate and the Accumulated Forward Net Position by Sector in Colombia

Source: Banco de la República and author’s calculations.

Relationship between the forwards positions and the spot exchange rate

The band spectrum regressions[3] show a positive relationship between changes in the offshore forward net position and the exchange rate returns at short-term frequencies. I find a significant influence of the offshore in explaining exchange rate returns at high frequencies of 4 to 16 days. For instance, an increase of USD 1’000 m at those frequencies depreciates the exchange rate by 1.8% and 1.5%, respectively.

The real sector has a negative relationship with the exchange rate over time for all horizons. Changes in its position in the forward market have significant influence on exchange rate returns. I find evidence that changes in the real sector forward positions have a higher effect on the exchange rate than the ones of the offshore sector. For instance, a USD 1’000 m purchase in the forward market by the real sector appreciates the currency by between 1.5% and 4.9%. The effect of changes in the forward positions of PSF and the IMC-Intra Group[4] on the exchange rate is higher at lower frequencies.

The effect of other fundamentals on the exchange rate, such as the interest rate differential, CDS, and oil prices is higher at lower frequencies, while US financial conditions have a permanent effect. This confirms the long-term nature of these fundamentals in explaining the exchange rate according to the exchange rate determination puzzle.

Overall, the research shows a strong correlation between exchange rate returns and the positions of foreign investors in the NDF market at high frequencies. By contrast, the correlation of exchange rate returns with the real sector is observed across all frequencies.

[1] See Gamboa-Estrada, F. (2023). The role of foreign investors and local agents in the derivatives market and their impact on the exchange rate in Colombia: A wavelet analysis.

[2] This approach is a time-frequency analysis that provides information about the main features of a time series at a specific frequency at a given point in time.

[3] The band spectrum regressions correspond to ordinary least square regressions (OLS) with (HAC) errors robust to heteroscedasticity and autocorrelation on a scale-scale basis. I use wavelet analysis to decompose dependent and explanatory variables into a set of different components that correspond to a particular frequency.

[4] Corresponds to the transactions between foreign exchange market intermediaries and foreign banks within the same financial group.