Handle with Care: Regulatory Easing in Times of Covid-19

The views expressed herein are those of the author and should not be attributed to the IMF, its Executive Board, or its management

__________

What happens when countries rapidly loosen financial regulations? Not a common undertaking by regulators. Yet the Covid-19 crisis has forced upon us a massive quasi natural experiment unfolding in real time.

An unprecedented regulatory response

Policymakers across jurisdictions embarked on a loosening of regulations on a never-seen-before scale as part of a wide-ranging policy support package. The unprecedented nature of these policy actions, and the fact that the COVID shock did not originate in the financial system (compared to the global financial crisis), offers us a unique opportunity to assess the effects of regulatory easing.

Given that regulatory measures were deployed at the same time as massive fiscal and monetary policy stimulus packages, it is difficult to disentangle their effects on macroeconomic outcomes such as growth and employment. However, asset prices reactions in the hours immediately after these measures are announced can provide valuable insight on how markets perceive a given policy action. In our latest paper, we use high-frequency data on financial and non-financial firms’ valuations to identify the effects of regulatory easing on financial markets. These results offer valuable clues to what may happen when financial regulations get tightened up once the effects from the COVID-19 shock dissipate.

A tough balancing act

Our analysis suggests that, overall, the announcement of easier financial regulatory constraints helped reverse the increase in the cost of borrowing and declines in asset prices—often summarized by indices called financial conditions, which deteriorated sharply at the onset of the crisis. However, these positive developments came on the back of increase stress in the financial sector, as financial equity prices declined significantly in the hour after regulators announced these measures (see text figure on the right).

We obtained these results from examining the reaction of stock prices to 240 regulatory announcements in a sample of 18 advanced economies and 8 emerging markets from February 1 to July 31, 2020. Furthermore, the analysis is conducted on isolated regulatory policy announcements—those that are neither part of a package nor within the same day of any other announcement. With additional methodological considerations detailed in the paper, this approach ensures the effects stem solely from the regulatory announcements and no other economic and policy measures.

To understand the economic forces behind our results, it helps to note that the main objective of these regulatory actions was to facilitate the flow of credit to the economy and mitigate negative asset price spirals, which if unaddressed could self-reinforce and lead to ripple effects throughout the economy. Yet regulatory easing can also raise concerns. Regulatory requirements are meant to discourage financial institutions from taking excessive risks by forcing them to maintain a more prudent composition of their balance sheet.

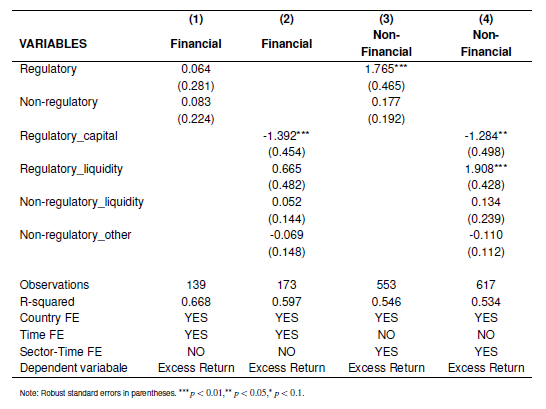

Table 1: Impact of regulatory announcements on Excess Equity Returns (at t=0)

Source: Authors’ calculations.

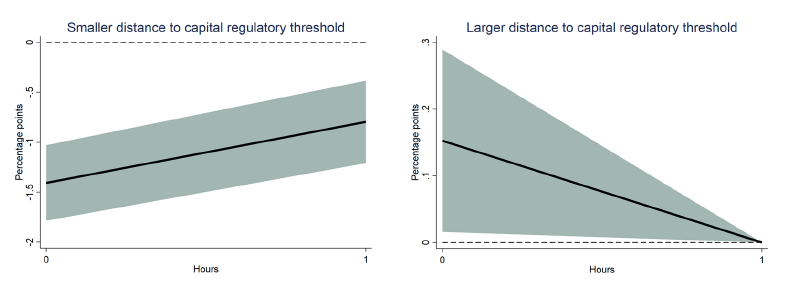

The negative reaction of financial sector stock prices would appear consistent with the latter concerns, by which investors react negatively to the announcement of easier regulatory constraints expecting that these actions could weaken incentives for banks to behave financially prudent—in other words, to take excessive risks. This increased risk-taking could take the form of increased leverage or making riskier loans, which could result in losses to banks down the road. We provide further evidence for the increased risk-taking channel interpretation by exploiting cross sectional variation in capital buffers across jurisdictions. By conditioning the financial stock prices responses on the size of capital buffers (measured as the distance from reported buffers to minimum regulatory thresholds), we find that the negative response following the announcement of regulatory relaxation is driven by jurisdictions with lower buffer availability. On the other hand, the benefits of avoiding a credit crunch were beneficial not only to the non-financial but also the financial sector in jurisdictions with ample capital buffers.

Figure 1. Cumulative impulse responses of excess returns of financial sector by capital buffer (percentage points)

Note: Impulse responses obtained using Jordà (2005) local projection methods.

Solid black line shows OLS point estimates. Teal shades are 90% confidence bands.

An alternative explanation is that facilitating credit flow in the current environment comes with an increased risk of lending to zombie firms—firms that are unable to meet debt servicing obligation from profits over a long period—reflecting the consequences on firms of possible economic scaring brought about by the COVID-19 pandemic.

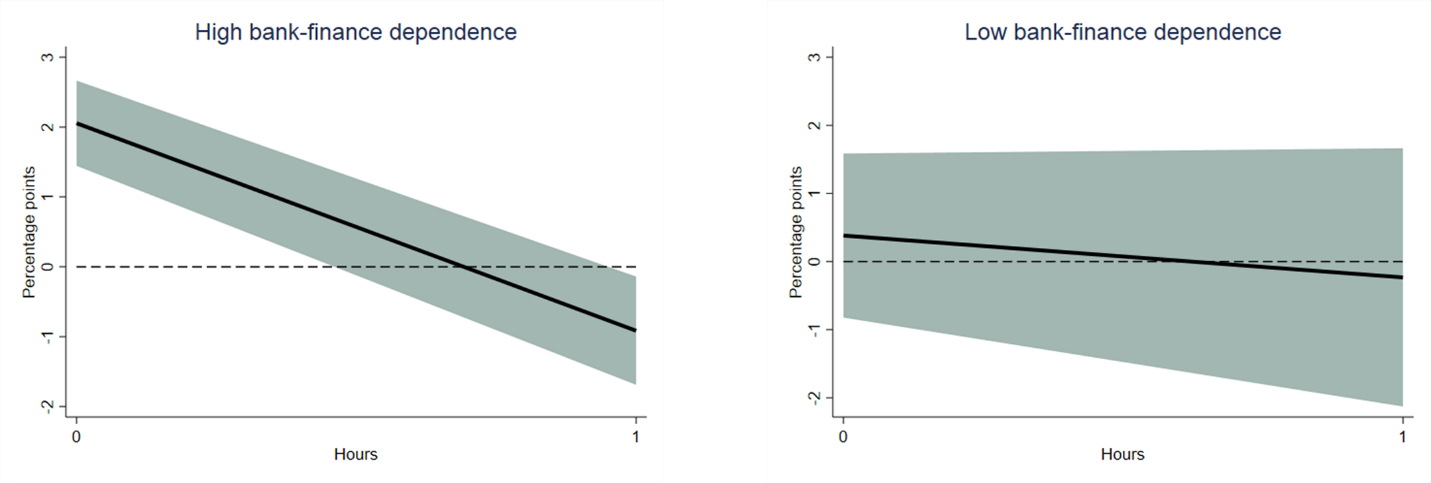

We interpret the positive response of nonfinancial sector as consistent with the positive effects expected from easier regulatory constraints on banks—which result in easier flow of credit to the private sector and more favorable financial conditions. This interpretation is further corroborated by the finding that the positive effect detected on the stock prices of nonfinancial firms is more pronounced for those industries that are more dependent on bank credit-finance financing (see text figure on the right). Their stock prices increased while the stock prices of the firms that are less dependent on bank financing did not exhibit any noticeable response on impact.

Figure 2. Cumulative impulse responses of excess returns of non-financial sector by bank-finance dependence (percentage points)

Note: Impulse responses obtained using Jordà (2005) local projection methods.

Solid black line shows OLS point estimates. Teal shades are 90% confidence bands.

Policy composition matters

The analysis also reveals that announcements related to looser liquidity regulation—such as lower reserve requirements—generally had a positive stock prices reaction on financial and nonfinancial firms. These announcements led to an immediate spike in returns in non-financial stocks. The effects on financial stock prices, while positive, are small and not statistically significant.

In contrast, announcements of easier capital-related prudential regulation were followed by a negative stock prices reaction—both for financial and non-financial sectors. Consistent with the interpretation of perceived increase in risk-taking by banks, these reactions could signal concerns about bank losses down the road. In turn, these losses could hamper banks’ ability to provide credit to the real economy in the future, all else equal.

Conclusions

In the near term, the easing of financial regulation, together with other policies, helped contain the negative effects of the COVID-19 shock. But these policy actions also involved tradeoffs, particularly if concerns about excessive risk taking by financial and non-financial firms materialize. Our results could also help inform the roll back of regulatory easing once the recovery is on a firm footing. The tradeoffs we document, for instance, appear to be smaller for liquidity measures as opposed to capital regulations—which suggests prioritizing capital related regulations over liquidity.

Fabián Valencia, Richard Varghese, Weijia Yao, and Juan F. Yépez[1]

[1] The authors are at the International Monetary Fund. This blog is based on IMF Working paper, Valencia, M. F., Varghese, R., Yao, W., & Yepez, J. (2021). Handle with Care: Regulatory Easing in Times of COVID-19. International Monetary Fund, Working Paper No. 2021/049.