Capital Markets, COVID-19 and Policy Measures

In addition to causing a global recession, the COVID-19 pandemic, spurred a dramatic response in capital markets (Alfaro et al., 2020; De Bock et al., 2020). As investors gauged the economic consequences of the pandemic and the subsequent policy responses, they initiated a wave of capital reallocation between markets and asset classes.

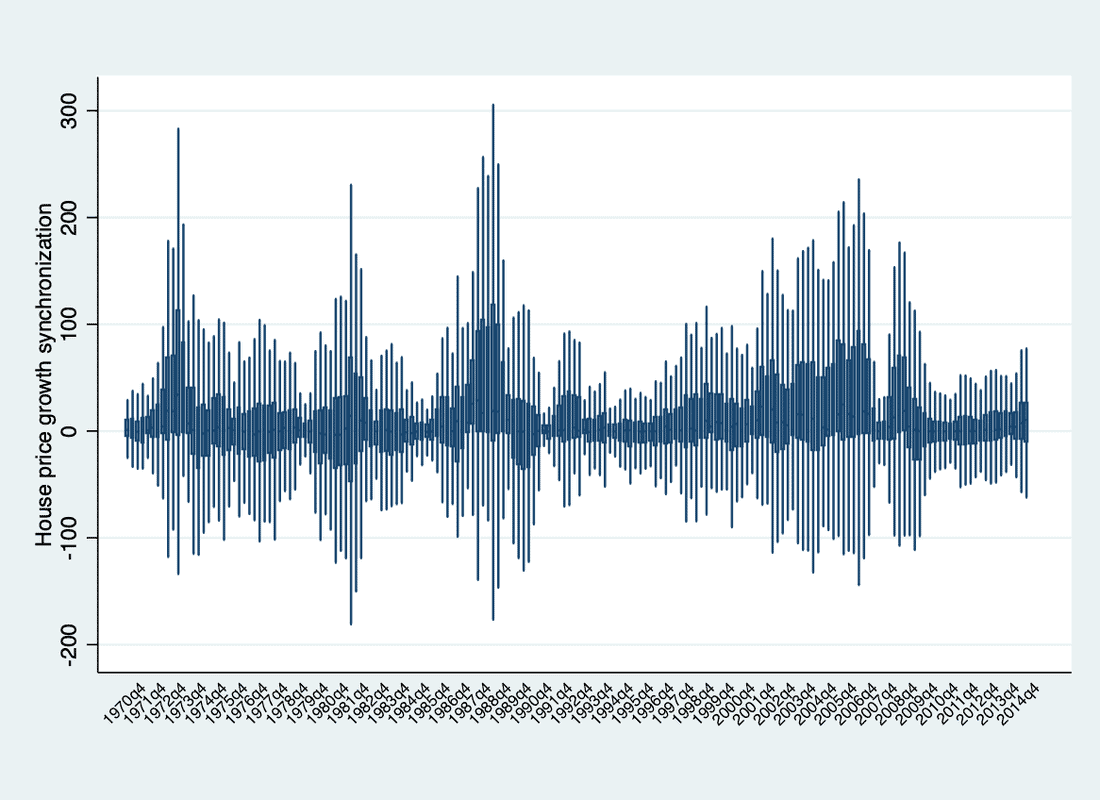

Using high-frequency weekly data of country-level portfolio flows, Figure 1 puts the impact of the pandemic in perspective with other events by showing the cross-sectional distribution of portfolio flows across countries on selected dates, with a net pullback by investors corresponding to densities that are more to the left. The global shift in international portfolio flows was of historically large magnitude and countries’ experience at the height of the episode differed widely. This heterogeneity suggests that domestic pull factors have played an important role, both directly and indirectly via their impact on countries’ sensitivity to the global shock.

Figure 1 Densities of portfolio flows (percent of allocation)

In a recent paper (ElFayoumi and Hengge, 2020), we examine if and how the number of domestic infections, the stringency of lockdown measures, and the fiscal and monetary policy response determined the magnitude of portfolio flows and market-implied sovereign risk during the COVID-19 pandemic.[2] In addition, we explore three sources of heterogeneity: market development (emerging (EMs) vs. developed markets (DMs)), asset classes (bonds vs. equities), and investors’ domicile (foreign vs. domestic).

Overall, our findings demonstrate that capital market dynamics were not exclusively driven by undiscriminating global factors. Instead, the severity of the pandemic at the domestic level and governments’ policy responses played a role in explaining the heterogeneity of portfolio flows and sovereign risk across countries during the COVID episode.

Effect of infections and policy responses on capital markets We build a panel dataset for 37 emerging and developed markets, with weekly information on the number of new COVID cases, the stringency of governments’ lockdown, and the fiscal and monetary policy response. Figure 2 summarizes the heterogeneity across countries’ experience of the virus and their policy responses. We match these data with weekly portfolio flows from EPFR and spreads of sovereign credit default swaps (CDS).

Figure 2 Heterogeneity in COVID cases and policy responses

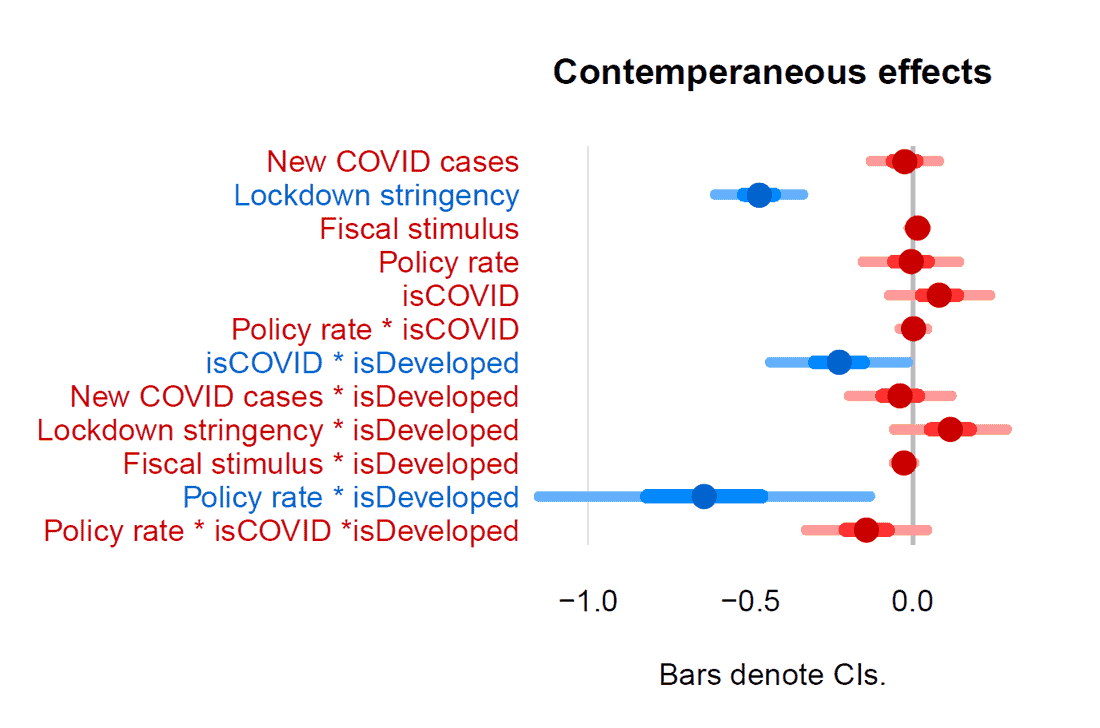

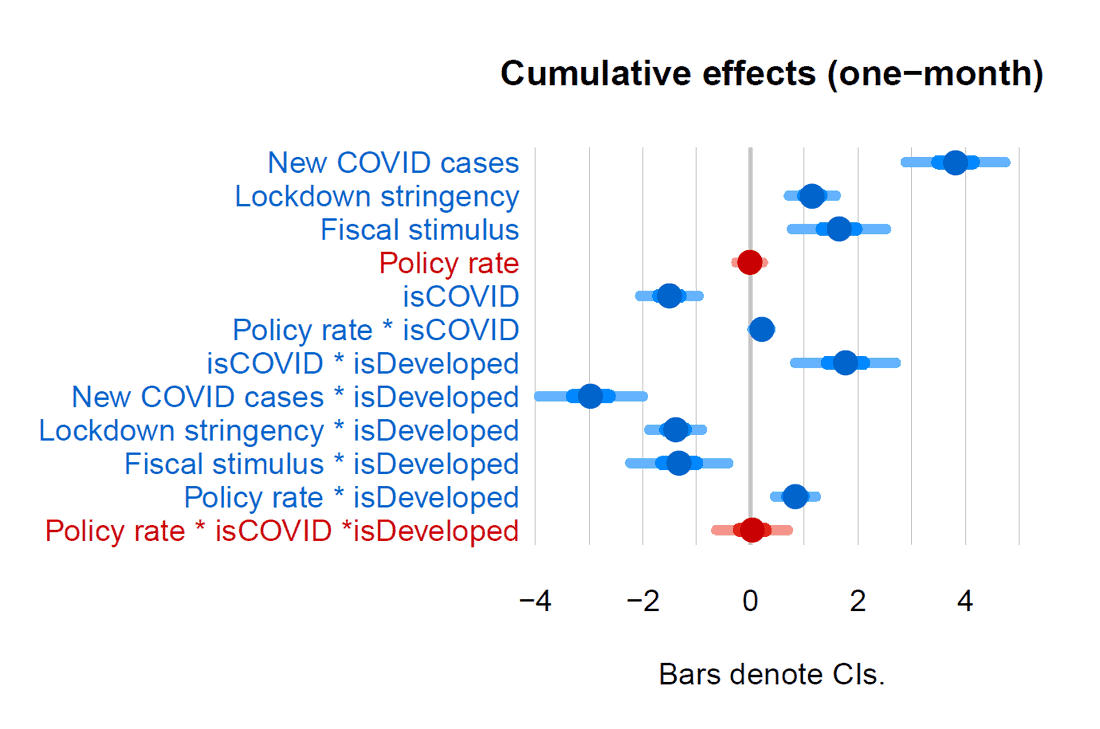

Our empirical approach relies on local projections (Jordà, 2005) to estimate both the contemporaneous and the cumulative response of flows to shocks over a one-month horizon. For identification, we rely on the high frequency of the data and the efficiency by which investors’ portfolios adjust to new market information. Both elements, as we discuss extensively in the paper, allow us to overcome the inherent endogeneity between the spread of the virus, policy actions, and market outcomes.

We find that the domestic spread of the virus led to a cumulative increase in total net portfolio flows[3] in EMs. This increase was associated with a reallocation towards safer assets as equity holdings declined and bond flows rose. Sovereign CDS spreads increased, suggesting that the increase in net portfolio flows was driven by demand for liquidity, potentially reflecting widening financing needs to mitigate the fallout from the pandemic.[4]

Our analysis also shows that, following an initial negative response, a more stringent lockdown led to larger net portfolio flows over the one-month horizon in EMs. Similarly, governments’ efforts to provide fiscal stimulus were successful in supporting higher portfolio flows to the domestic economy. Unlike the case for COVID infections, evidence from the CDS market suggests that the increase in flows was dominated by supply forces, reflecting investors’ preference for stronger policy responses.

With respect to monetary policy, we do not find a significant contemporaneous impact of a rate cut on portfolio flows in EMs. Yet, in DMs, they triggered an increase in net portfolio flows upon impact as central bank actions provided reassurance to markets, stimulating flows to the domestic economy. Over the horizon of a month, however, we find that monetary policy cuts led to a decline in net portfolio flows both in EMs and DMs, as expected by the interest rate parity and search for yield channels. Figure 3 shows the dynamic response of total portfolio flows to shocks to the domestic COVID factors.

Figure 3 Impact of domestic COVID cases and policy response on total net portfolio flows

Policy measures and the global shock

In addition to their direct effect, domestic policy measures can also impact the dynamics of portfolio flows by mitigating or exacerbating the impact of the global shock. Our findings indicate that stricter lockdown measures and expansionary monetary policy actions helped mitigate the negative impact of the global shock on portfolio flows. In contrast, we find that larger fiscal stimulus exacerbated the impact of the global shock cumulatively, despite an initial positive effect.

Historical contribution of domestic COVID factors and global shocks

Notwithstanding the significant and sizeable role of domestic COVID factors, a historical decomposition analysis suggests that global factors played the larger role in explaining portfolio flow movements during the COVID episode. Their effect was negative and orders of magnitude larger in comparison to the COVID-related domestic factors, especially during the early and most uncertain phase of the pandemic. The large difference in magnitude between global and domestic COVID factors suggests that other county-specific policy and institutional factors were responsible for why the net historical effect on portfolio flows in EMs was not as negative as the estimated contribution of the global shock during the pandemic would suggest.

Authors’ note: The views expressed are those of the authors and do not necessarily represent the views of the IMF, its Executive Board, or IMF management.

References

Alfaro, Laura, Anusha Chari, Andrew Greenland, and Peter K. Scott (2020). Covid Economics: Vetted and Real-Time Papers, 4, pp. 2-24.

Avdjiev, Stefan, Leonardo Gambacorta, Linda S. Goldberg, and Stefano Schiaffi (2020). The shifting drivers of global liquidity. Journal of International Economics, 125, pp. 103324.

De Bock, Reinout, Dimitris Drakopoulos, Rohit Goel, Lucyna Gornicka, Evan Papageorgiou, Patrick Schneider, and Can Sever (2020). Managing volatile capital flows in emerging and frontier markets. VoxEU.org, 19 August.

ElFayoumi, Khalid and Martina Hengge (2020). Capital Markets, COVID-19 and Policy Measures. Covid Economics: Vetted and Real-Time Papers, 45, pp. 32-64. Fratzscher, Marcel (2012). Capital flows, push versus pull factors and the global financial crisis. Journal of International Economics, 88(2), pp. 341-356.

Gilchrist, Simon and Zakrajšek, Egon (2012). Credit spreads and business cycle fluctuations. American Economic Review, 102(4), pp.1692-1720.

Jordà, Òscar (2005). Estimation and inference of impulse responses by local projections. American Economic Review, 95(1), pp. 161182.

Rey, Hélène (2015). Dilemma not trilemma: the global financial cycle and monetary policy independence. National Burau of Economic Research.

Endnotes

- An earlier version of this blog was published on VoxEU.org.

- The analysis focuses on the domestic component of these variables, while controlling for global factors.

- Total net portfolio flows are defined as the net value of purchases and redemptions of bond and equity funds.

- Combined, information about the quantity (flows) and price (CDS spreads and stock prices) of assets provides an identification of the supply and demand channels of portfolio flows. To the extent that these two measures are tightly linked by market forces, shifts in supply are associated with changes in flows and spreads in opposite directions, whereas shifts in demand move both variables in the same direction. This intuition is in line with Gilchrist and Zakrajšek (2012) who study the relative contribution of credit supply and demand factors in corporate bonds.