Non-US global banks and dollar (co-)dependence how housing markets became internationally synchronized

Torsten Ehlers (Bank for international Settlements), Mathias Hoffmann (University of Zurich), Alexander Raabe (European Stability Mechanism)

The views expressed here are those of the authors and do not necessarily reflect those of the BIS or the ESM. The analysis was completed before Alexander Raabe joined the ESM.

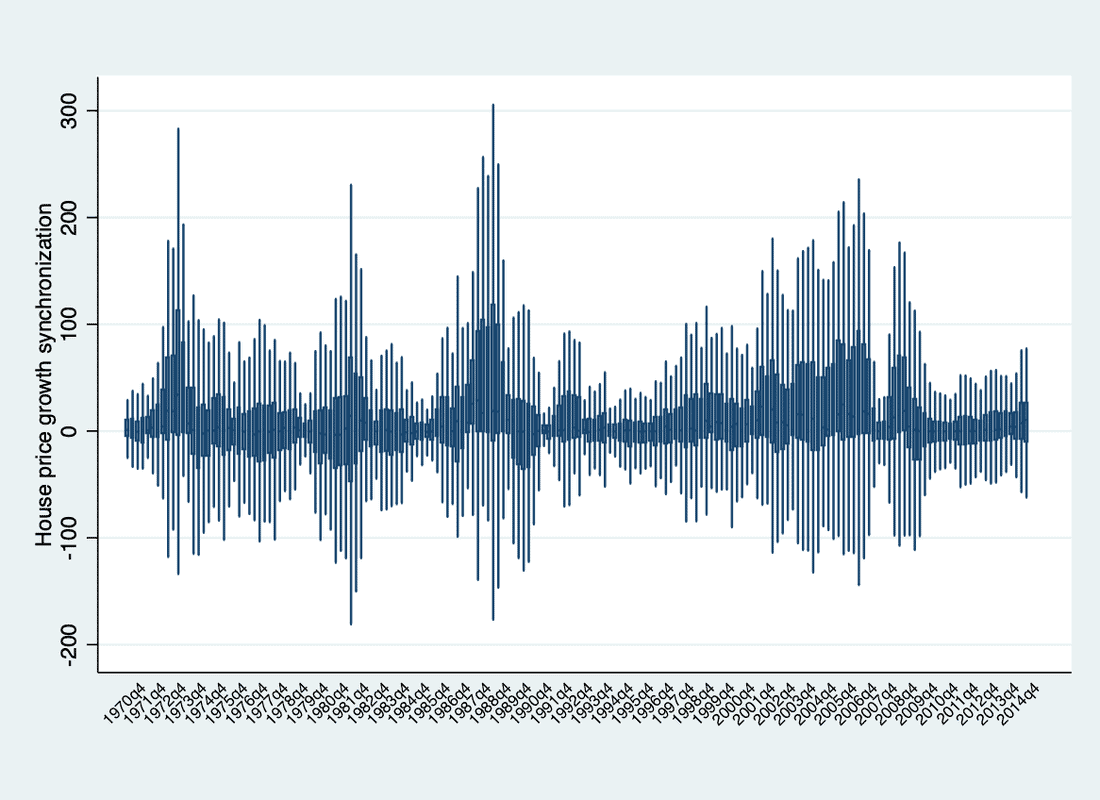

House prices co-move across countries to an extent that varies over time and country pairs. Figure 1 shows that periods of high co-movement alternate with periods where co-movement is low, and that the dispersion of house price co-movement across country pairs varies significantly. In most countries, housing is the main channel linking financial sector and macroeconomic developments, as it is the largest component of household wealth and the single most important collateralizable asset. To understand the role of housing for macroeconomic dynamics at the global level, it is paramount to understand what drives the international co-movement of house prices. In a recent study (Ehlers et al., 2020), we assess how US dollar funding conditions and the international banking network affect the co-movement in house prices.

Figure 1: House price synchronization, 1970Q1-2015Q1

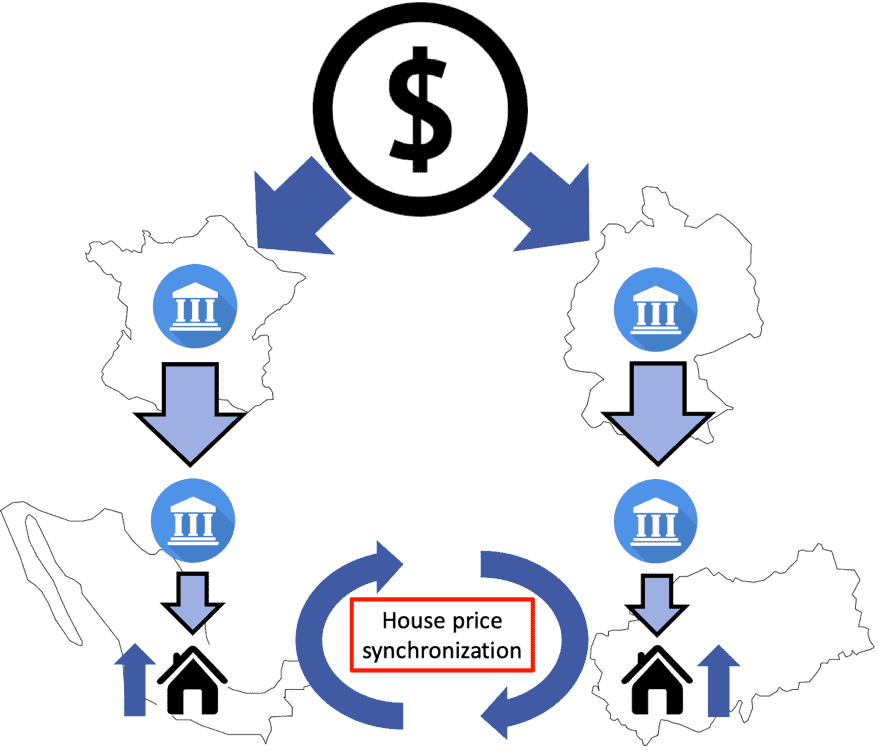

Our analysis shows that capital inflows into the US are an important determinant of house price co-movement around the globe. As more capital flows on net into the US from the rest of the world, it becomes easier for non-US global banks to borrow in US dollars. As non-US global banks finance about 45 percent of their foreign lending in US dollars (on average), they are exposed to variations in US dollar funding conditions. These variations drive these banks’ foreign lending to third-party borrowing countries – a concept we call dollar dependence. We construct the empirical counterpart for the novel concept of dollar dependence by combining granular data from the BIS consolidated and locational international banking statistics. Recipient banks in the borrowing countries allocate much of the foreign lending to mortgage markets, resulting in pressure on house prices. As this pattern is observed across borrowing countries, housing markets in these countries co-move more strongly.

Figure 2 illustrates the mechanism, which implies higher house price synchronization in response to shifts in US dollar funding conditions between any two borrowing countries that receive foreign lending from non-US global creditor banks which are more dependent on US dollar funding. That is, the effect of dollar funding conditions on house price co-movement increases in what we call dollar co-dependence, defined as the extent to which two borrowing countries jointly rely on dollar-dependent creditors.

Figure 2:

Importantly, the synchronization is driven by non-US global banks’ common but heterogeneous exposure to US dollar funding conditions, and not by the common exposure of borrowing countries to non-US global banks across all currencies. Similarly, it is non-US banks that play the biggest role in transmitting the shifts in US dollar funding conditions to borrowing countries, not US banks. These non-US global banks are headquartered in a few major advanced economies, notably in Germany, France, the UK, the Netherlands, Switzerland and Japan.

To identify the mechanism, we develop a statistical model that relates US dollar funding conditions and the dollar dependence of non-US global banks to the international synchronization of house prices. The model allows us to derive a relationship between the pairwise international house price synchronization and borrowing countries’ dollar co-dependence. We test this relationship empirically using panel regressions.

Our results indicate a positive relationship between the dollar co-dependence and the international synchronization of house prices. In particular, an increase in dollar co-dependence of the average country pair by 10 percentage points is associated with an increase of house price synchronization by 38 percent relative to its mean. This result is confirmed when we explore several intermediate steps in the mechanism. An important intermediate step is that the foreign lending supply induced by shifts in US dollar funding conditions affects mortgage credit growth of banks in borrowing countries.

We demonstrate a positive relationship between dollar co-dependence and the international synchronization of mortgage credit growth. We also find that the effect of US dollar funding conditions on non-US global creditor banks’ foreign lending supply is increasing in their dollar dependence, in particular when foreign lending is denominated in US dollars. These results are robust to a battery of robustness checks, including a rich set of controls and fixed effects.