Inflation Expectations and Weather Shocks in Colombia

Understanding the impact of weather shocks on the economy has become increasingly relevant, as they can affect GDP growth, agricultural sector performance, and inflation. This increased relevance is underscored by the recent surge in the number of economic studies examining these impacts. Among the sources of extreme weather shocks, El Niño Southern Oscillation (ENSO) has been one of major interest given its wide-ranging impacts on global weather. Furthermore, recent research conducted by the US National Oceanic and Atmospheric Administration (NOAA) indicates that if greenhouse gas emissions continue rapidly, the frequency of extreme El Niño and La Niña events could potentially double by the end of this century. This would mean that instead of extreme events related to ENSO fluctuations taking place every twenty years, they could occur every ten years (McPhaden et al., 2020).

ENSO is a significant climatic phenomenon that involves a complex interaction between sea surface temperature in the Pacific Ocean and air pressure. It has worldwide implications for weather alternating between El Niño and La Niña phases. These weather fluctuations, triggered by ENSO, have profoundly impacted specific economic indicators in Colombia, such as food prices, inflation, inflation expectations, and agricultural output. Understanding these impacts is crucial for policymakers and researchers alike.

In a recent study,[1] José Vicente Romero and Sara Naranjo of the Central Bank of Colombia[2] assess how adverse weather events associated with ENSO can be incorporated into a macroeconomic model. This model includes the impact of weather events on macroeconomic variables and inflation expectations and is designed for use in policy analysis and simulations at the horizon relevant for monetary policy decisions, that is, around eight quarters.

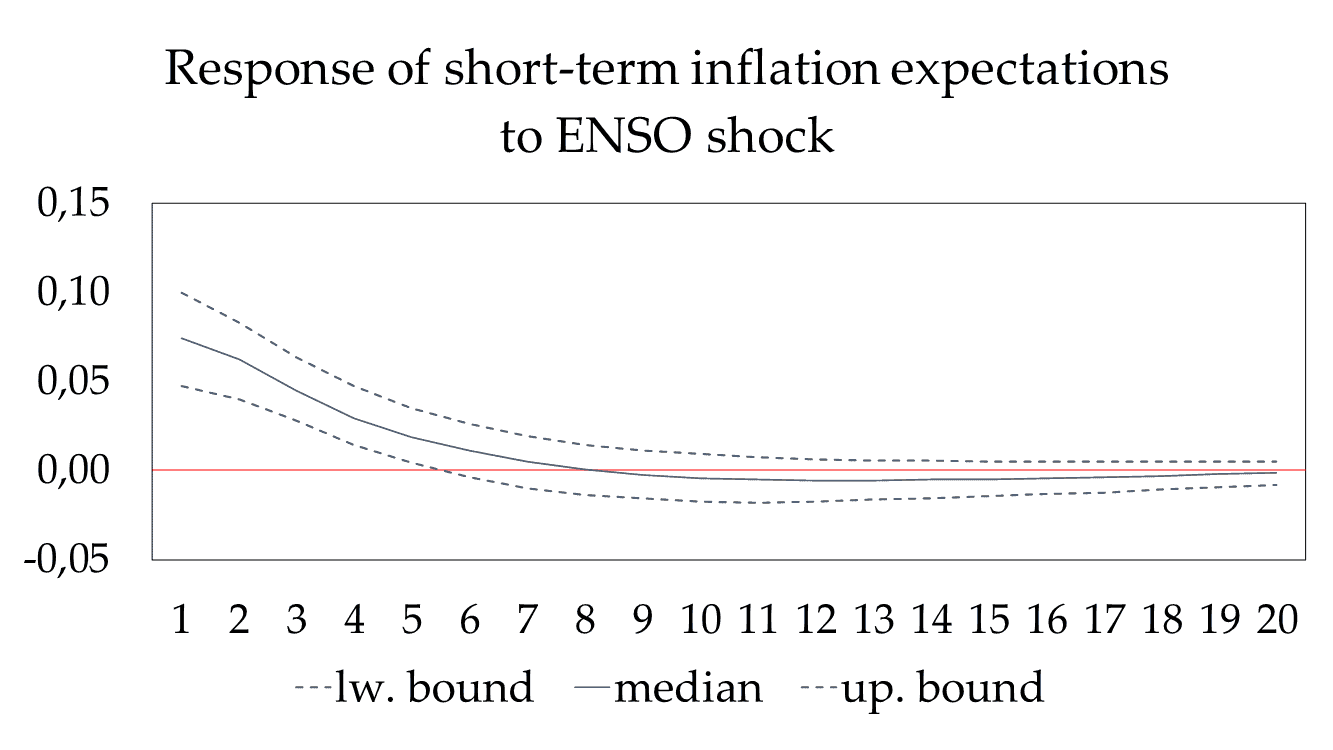

The authors’ empirical analysis shows that ENSO fluctuations may have second-round effects through their impact on agents’ inflation expectations. Using the ENSO index to inform an exogenous weather shock in a Bayesian vector autoregression (BVARx) estimated for Colombia, the authors find evidence that weather shocks push short- and long-run inflation expectations, as shown in Figure 1.

Figure 1. Response of short and long-term inflation expectations to 1-degree Celsius shock in the ENSO index.

|

|

| Source: Authors’ computations. Note: Short- and long-run inflation expectations are constructed using the principal component of an ample set of inflation expectations series in Colombia as described in the document. The y-axis scale corresponds to percentage points. | |

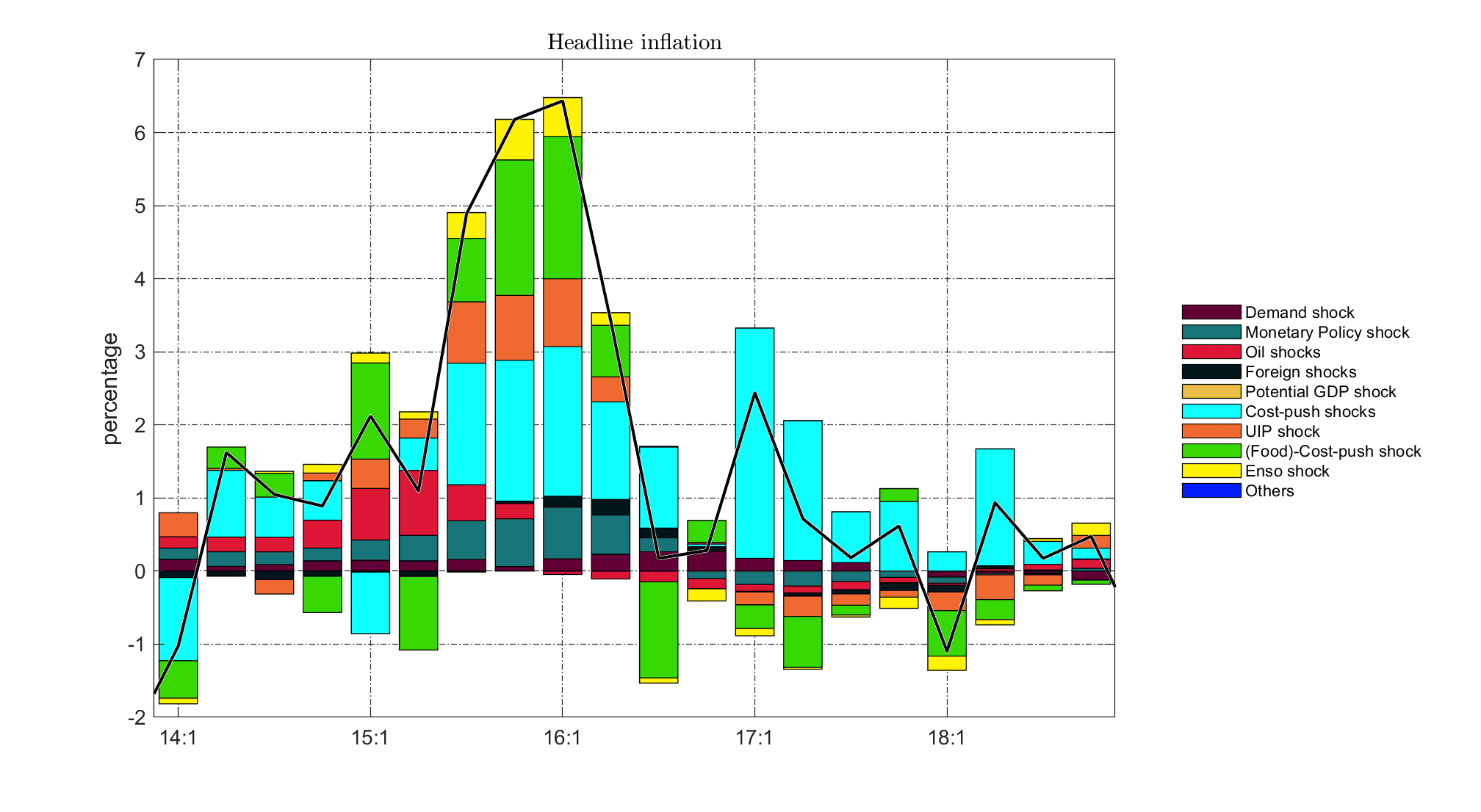

The researchers leverage these findings to develop a semi-structural small open economy Neo-Keynesian model for use in further simulations. This model factors weather as a determinant of the marginal costs of regulated goods and food prices. Including these elements effectively isolates weather shocks from other economic disturbances, enabling a focused study of how ENSO impacted the Colombian economy in 2016, a period where the Colombian economy was affected by a wide array of adverse shocks. As depicted in Figure 2, the model reveals that 2016 headline inflation was significantly driven by cost-push shocks related to strikes in the agricultural and transportation sectors (green bars) and the impact of ENSO shocks on food and electric energy prices (yellow bars), something that otherwise could be hard to disentangle.

Figure 2. Contribution of exogenous shocks to headline inflation during 2016 (Shock decomposition).

Source: Authors’ computations.

Another key aspect of the approach is to incorporate a non-linear effect of weather shocks on the economy. The shock initially triggers an increase in inflation expectations. If the central bank is fully credible, these expectations will adjust back as the shock subsides, aligning with rational expectations. However, if the central bank’s credibility is not absolute, the model shows a second-round effect where people anticipate higher inflation. This then requires the central bank to exert more effort to bring inflation down to its target level. In summary, the modeling approach provides a framework to assess how weather shocks can potentially lead to stagflationary supply shocks. This situation could complicate the central bank’s task of anchoring inflation expectations, underscoring the crucial role of central bank credibility in managing these adverse weather-related events.

[1] Romero, J. V., & Naranjo-Saldarriaga, S. (2024). Weather shocks and inflation expectations in semi-structural models. Latin American Journal of Central Banking, 5(2), 100112. This document also received the 2024 Economics in Central Banking award by Central Banking (https://www.centralbanking.com/central-banks/economics/economic-modelling/7960668/economics-in-central-banking-jose-vicente-romero-and-sara-naranjo-saldarriaga-central-bank-of-colombia).

[2] This research was supported by the Graduate Institute Geneva’s BCC Program and Professor Emanuele Campiglio from the University of Bologna.